How to Apply for a Tax File Number (TFN) in New South Wales: A Beginner’s Guide

Applying for an Australian Tax File Number (TFN) in New South Wales is a crucial first step for anyone looking to work, study, or start a business in Australia. This beginner-friendly guide breaks down each step to help you complete the application with ease.

1. What is a TFN and Why Do You Need It?

A TFN (Tax File Number) is a unique identification number issued by the Australian Taxation Office (ATO). It acts as your personal tax ID, linking your work income, bank interest, government benefits, and superannuation (pension fund). Having a TFN ensures your tax matters are correctly managed, giving you access to certain tax benefits and avoiding high withholding rates.

Example: Jack, on a working holiday visa, finds a job in Sydney. But without a TFN, his employer must withhold tax at 45%. After applying for a TFN, Jack’s tax rate drops to 15%, and he discovers he can claim back excess tax withheld at the end of the financial year, saving him money.

2. Before You Apply

Step 1: Confirm Your Visa Type

The ATO has different application processes based on visa type. Make sure you know which category applies to you:

Australian residents (citizens or permanent residents)

Temporary visa holders with work rights (e.g., student visas, working holiday visas, temporary work visas)

Step 2: Gather Your Information

Whether applying online or by mail, have the following details ready:

Passport or other ID documents

Visa information (for temporary visa holders)

An Australian address (for receiving your TFN letter)

Tip: Ensure your address is accurate and accessible to avoid missed or delayed mail.

3. How to Apply for a TFN: Step-by-Step Instructions

Method 1: Online Application (For Eligible Visa Holders)

Visit the ATO Website

Go to https://www.ato.gov.au and click “Apply for a TFN.”Create a myGov Account and Link to the ATO

If you don’t have a myGov account, click “Create account” to register. myGov is the Australian government’s online services portal, giving you access to a range of government services.

After logging in, select the ATO from the list to link it to your myGov account.

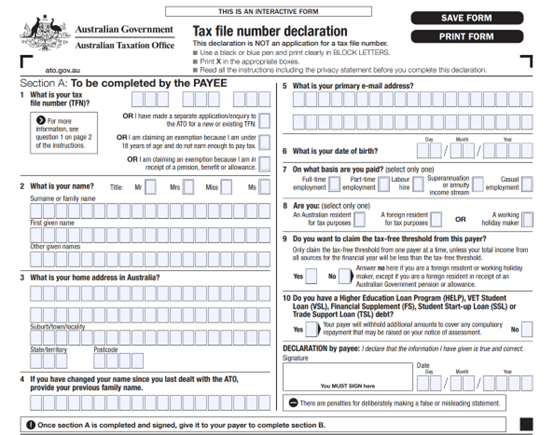

Complete the Online TFN Application Form

Once linked, navigate to the “Tax” section, select “Apply for a TFN,” and follow the prompts to enter your details (name, date of birth, visa type, and Australian address).

Submit and Save the Confirmation

After submission, a confirmation page will appear. Take a screenshot or save it for reference.

Obtain the Form

Download the paper form from the ATO website or pick one up from a local ATO office.Fill Out the Form

Follow the instructions carefully and ensure your details are accurate.Post the Form

Mail the completed form to the ATO’s specified address. Processing times may be longer, so it’s best to apply early.Processing Time

The ATO generally processes TFN applications within 28 days, though timing may vary with postal delays or peak periods.Check Your Application Status

If your TFN hasn’t arrived after 28 days, check your status through myGov or by calling ATO customer service.

Note: The online application is quick and ideal for most applicants, especially those on student or working holiday visas.

Method 2: Paper Application (For Australian Residents)

Example: Lily, a new permanent resident, chose to apply by post. Due to the busy holiday season, her TFN took six weeks to arrive, teaching her the importance of applying early.

4. While Waiting for Your TFN

Tip: ATO customer service can be busy; try calling during early hours or off-peak times for faster service.

5. After Receiving Your TFN

Step 1: Inform Your Employer

Once you receive your TFN, let your employer know immediately so they can update your tax information and apply the correct tax rate.

Step 2: Keep Your TFN Secure

Your TFN is sensitive information, so keep it safe and don’t share it unnecessarily to avoid misuse or identity theft.

Step 3: Prepare for Tax Season

Australia’s financial year runs from July 1 to June 30. During tax season (usually in July), you can use your TFN to lodge your tax return through myGov.

Example: Zoe, a student, submitted her tax return online after receiving her TFN and was pleasantly surprised to claim back some overpaid tax.

6. Frequently Asked Questions

Q1: Can I expedite my TFN application?

The ATO doesn’t offer expedited processing, so apply early to avoid issues with income or work.

Q2: Can I work without a TFN?

You can, but your employer will withhold tax at a higher rate. Once you receive your TFN, you can contact your employer to update your tax rate.

Q3: Does a TFN expire?

Your TFN is valid for life. Even if your visa or residency status changes, you don’t need to reapply.

Q4: How can I protect my TFN?

Only share your TFN when necessary (e.g., with your employer or bank) and keep it private to prevent identity theft.

Applying for a TFN may seem complex, but it’s straightforward if you follow these steps. A TFN is essential for managing your income and tax matters in Australia, letting you access available tax benefits and services. Once you have your TFN, learning a bit about Australia’s tax system can help you avoid overpaying and stay financially organized.

We hope this guide helps you obtain your TFN easily and enjoy a smooth start in Australia! For further guidance on tax returns or refunds, feel free to reach out.

1300 91 66 77

1300 91 66 77

HOME

HOME